Friday, September 29, 2023

Announcing Sticky Base Pricing and Sticky Booked Rate Parameters

Announcing Sticky Base Pricing and Sticky Booked Rate Parameters

At GPTPricing, we understand that algorithms aren’t always perfect. In some cases, pricing models can overestimate factors like negative collisions or cluster breaks, leading to rates that deviate from market realities. To address these scenarios, we’re excited to introduce Sticky Base Pricing and Sticky Booked Rate Parameters, two powerful tools designed to keep pricing anchored to historical performance and market expectations.

What Are Sticky Base and Booked Rate Parameters?

These new parameters provide property owners with the flexibility to pull pricing closer to historical trends when needed. By leveraging exponentially sticky pricing, our system can dynamically adjust rates toward either:

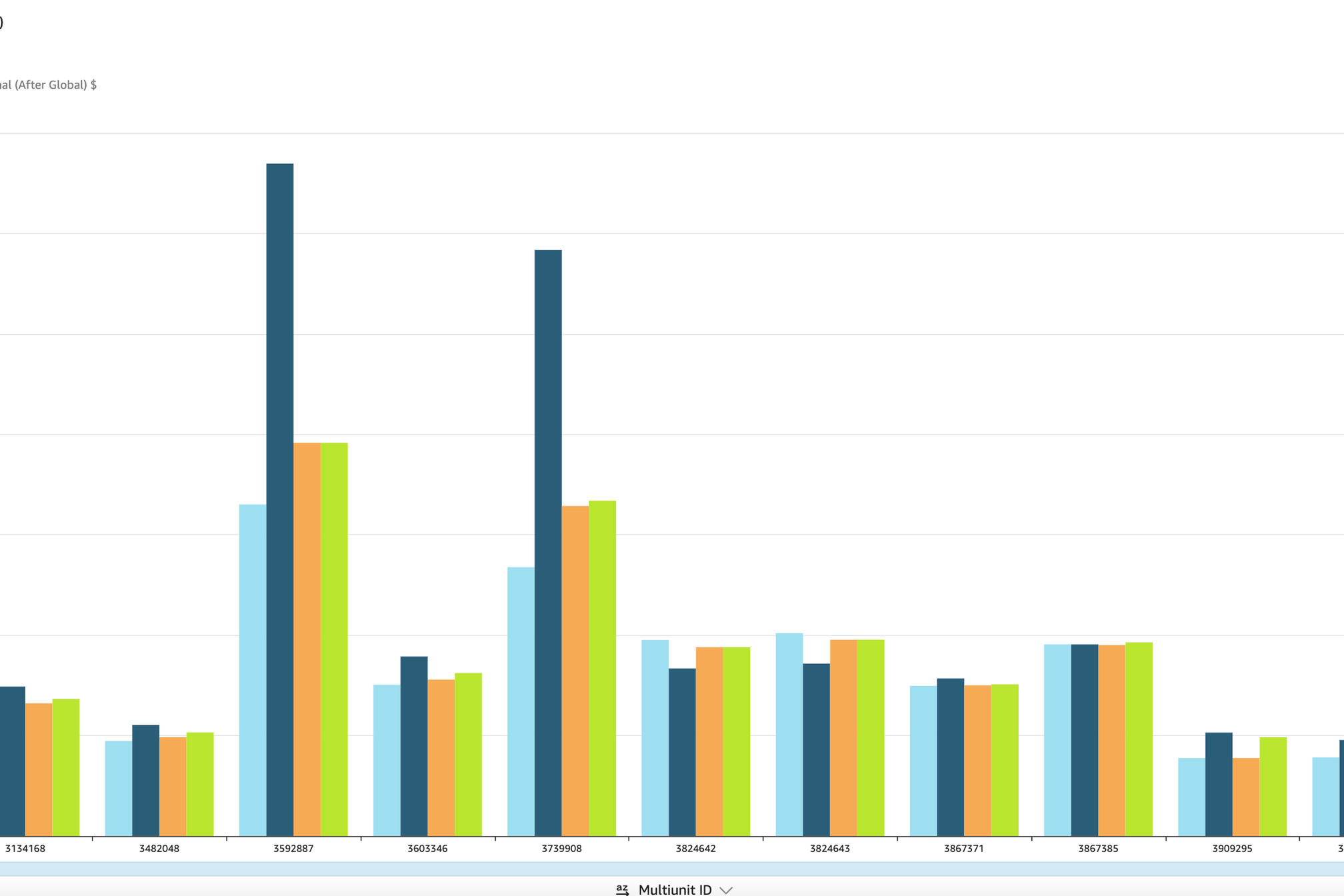

• Sticky Base Pricing: Anchors prices to the market base rate from previous years. This ensures that rates remain competitive and realistic, even when algorithmic projections suggest drastic changes.

• Sticky Booked Rate Pricing: Pulls prices toward the actual booked rates from prior years, offering a safeguard against over- or underpricing for similar stay patterns.

How Sticky Pricing Works

Imagine a scenario where the pricing algorithm predicts a steep rate increase due to perceived negative collisions or a cluster break. While such adjustments often improve revenue, there are cases where they overestimate the impact, creating outlier prices that may not align with market realities.

With Sticky Base or Sticky Booked Rate Parameters, owners can counter these outliers by incrementally pulling prices toward their historical benchmarks. This exponential stickiness ensures that prices naturally gravitate toward expected levels without completely overriding the algorithm’s optimizations.

• Upside Adjustments: If the algorithm undervalues certain dates, sticky pricing pulls rates upward toward past booked rates, ensuring revenue potential isn’t lost.

• Downside Adjustments: If prices are inflated due to overestimated factors, sticky pricing moderates them downward to match historical trends and market demand.

Why Sticky Pricing Matters

Sticky Base and Booked Rate Parameters offer significant benefits to property owners:

1. Improved Pricing Accuracy: By anchoring prices to historical performance, these parameters reduce the risk of over- or underpricing due to algorithmic anomalies.

2. Market Realism: Ensures rates stay competitive and aligned with actual market trends, even when the algorithm predicts extreme adjustments.

3. Flexibility and Control: Owners gain a powerful tool to fine-tune pricing strategies, leveraging historical data to complement algorithmic insights.

4. Adaptability to Outliers: Handles unusual situations, like unexpected cluster breaks or overestimated negative collisions, with pricing adjustments that stay grounded in reality.

Unlock the Power of Sticky Pricing

Sticky Base Pricing and Sticky Booked Rate Parameters represent the next evolution in pricing optimization, offering a seamless balance between algorithmic intelligence and market realism. By giving property owners greater control over how prices respond to historical data, GPTPricing ensures rates remain accurate, competitive, and optimized for success.

These features are now live for all GPTPricing users. Ready to take your pricing strategy to the next level? Contact us today to learn more or activate Sticky Pricing Parameters in your portfolio!